Should a Sales Brochure Underlie US Spectrum Policy?

The FCC relies on Cisco’s forecast of mobile-broadband data demand as a basis for spectrum policy. Called the Visual Networking Index, it comes up many times in the National Broadband Plan, in other documents, and in speeches.

There is overlap between the people who prepare the forecast and the people responsible for marketing Cisco’s line of core-network hardware to service providers. The forecast is used to help sell that hardware. Put simply, it’s a sales brochure. For business purposes, that’s fine. We look at marketing materials all the time, get useful information from them, consider the source, and make a decision. In spectrum policy, we’re not doing that. We’re taking Cisco’s claims as-is, and not considering how the company’s interest in selling hardware might influence its forecast, let alone critically and openly examining the assumptions that go into the forecast.

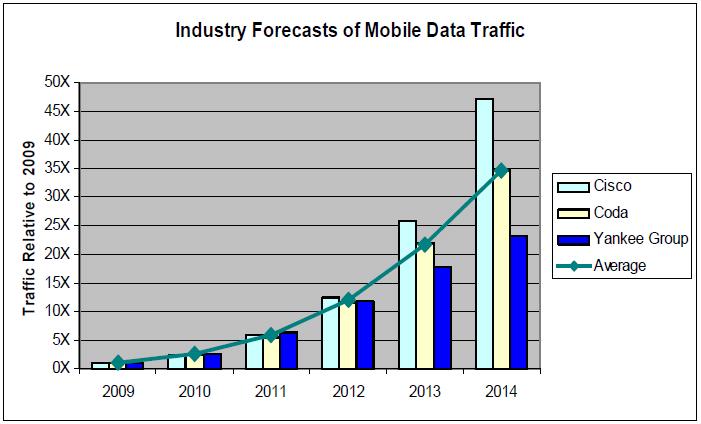

The Commission should rely more heavily on two forecasts in its possession that, unlike Cisco’s, are independently prepared. One is by Yankee Group and the other is by Coda – both independent research firms. These two forecasts are cited, along with Cisco’s, in the FCC’s October 2010 Technical Paper, Mobile Broadband: The Benefits Of Additional Spectrum. A chart from the report comparing three forecasts is shown below.

As with any sales pitch, whenever you hear a spectrum claim, consider the source.

[cross-posted from Steve Crowley’s blog]

Another take on Cisco’s forecast . . .

http://tmfassociates.com/blog/2011/04/07/how-wrong-is-cisco/

[…] they been, would have acted to reduce the estimate of short-term spectrum requirements. Later, I questioned the appropriateness of the FCC relying on a forecast prepared by the marketing department of an […]