AT&T and T-Mobile – Interpreting the Spin

AT&T and T-Mobile have collected their press release and associated documents on one web site. A few points caught my eye.

“AT&T is now burning through 10 MHz of spectrum every 10 months”, “AT&T and TMobile [sic] are both facing impending spectrum exhaust challenges” Translation: Among all the many options for addressing increasing demand, including increased offloading, improved network technology, and raising rates, this acquisition has the highest value.

“Critical time — at the beginning of transition to LTE” A noteworthy time, anyway. Evolved 3G networks such as HSPA+ can exceed the performance of 4G LTE, depending on how both are deployed. HSPA+ actually has a pretty good evolution path. It’s nice to converge on one, and it will probably be LTE instead of HSPA+, but I’m not feeling any particular time pressure.

“AT&T Mobile Data Volumes Up 8,000% Over Four Years” You see figures like this from time to time, not often from engineers. I’d like to know more details behind it such as what exactly is meant by “data volumes” and where in the network the measurement comes from. When the marginal cost to the consumer of an additional bit of data is zero, I’m not surprised by big increases in utilization.

“8x–10x Volume Growth Over Next Five Years” At what point in the network? Is the capacity present to handle this once the deal is done? If not, how will this expected increase be handled? How much of this 8x-10x is offloaded to Wi-Fi or other technologies? How will capacity be constrained by backhaul, if at all?

“Results in an American company investing in America. LTE infrastructure enables U.S. high-tech industry, U.S. economy. Enables the next era of American innovation.” When I first read this quickly, I thought they were making a commitment to buy infrastructure equipment from US vendors. Reading it more carefully I see they’re not. Elsewhere they note that “German-owned T-Mobile” is “the only major foreign-controlled U.S. telecom network” and it “becomes part of a U.S.-based company” after the deal goes through. Does “investing in America” include buying equipment from US-based companies only? If not, why bring up the Germans?

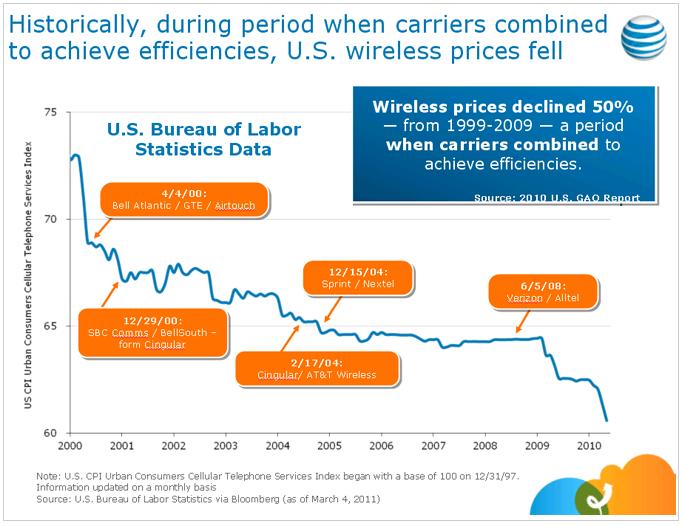

One slide, below, is intended to demonstrate that wireless prices declined 50% from 1999 to 2009, a period when carriers combined to achieve efficiencies. I wonder what the graph would have looked liked had these companies not combined.

[cross-posted from Steve Crowley’s blog]