Welcome to New Cable TV

A lot of Internet and cable TV policy these days presumes that the status quo for

Internet services and pay TV will persist indefinitely. Without this assumption, there’s no reason for the FCC to take a stab at upending the markets for set-top boxes and interconnection between ISPs and the “edge services” providers such as Netflix and Google.

But the FCC’s actions in these two markets appear to be contradictory. If pay TV is shifting from the linear model to an on-demand model, the economics and technology are radically different. But let’s define the terms: Linear TV, typified by cable and satellite distribution, is a system in which programs are selected by the cable/satellite TV provider and users simply choose from a menu. This menu may consist of several hundred programs, but it’s the same for everyone in the market or region. Linear programs are broadcast whether anyone watches or not.

On-demand is where the program is only transmitted in response to user request. This is great insofar as it prevents bandwidth consumption by programs that no one is interested in, but it doesn’t scale as well for programs that millions of people are watching. The nice thing about linear is that a million viewers of a given program don’t stress the system more than one viewer.

Efficiency is nice as an abstract concept, but when the cost of communication bandwidth falls below a certain floor level, it ceases to be the dominant cost factor. The on-demand model has its own economic advantage as long as TV is so heavily dependent on advertising, because it can be supported by ads targeted at the interests of particular viewers. This is computationally complex, but in principle a targeted ad can be sold for a higher price than a generic ad.

The TV market today is a combination of linear and on-demand. Not only do we watch on-demand from Netflix, Hulu, and Amazon, the cable companies and networks will stream programs to us on-demand, either for an additional fee or for no additional charge. Cable on-demand programming often has restrictions on VCR controls (fast forward and 30 second skip especially) that force us to watch commercials, but with or without these limitations it’s still on-demand.

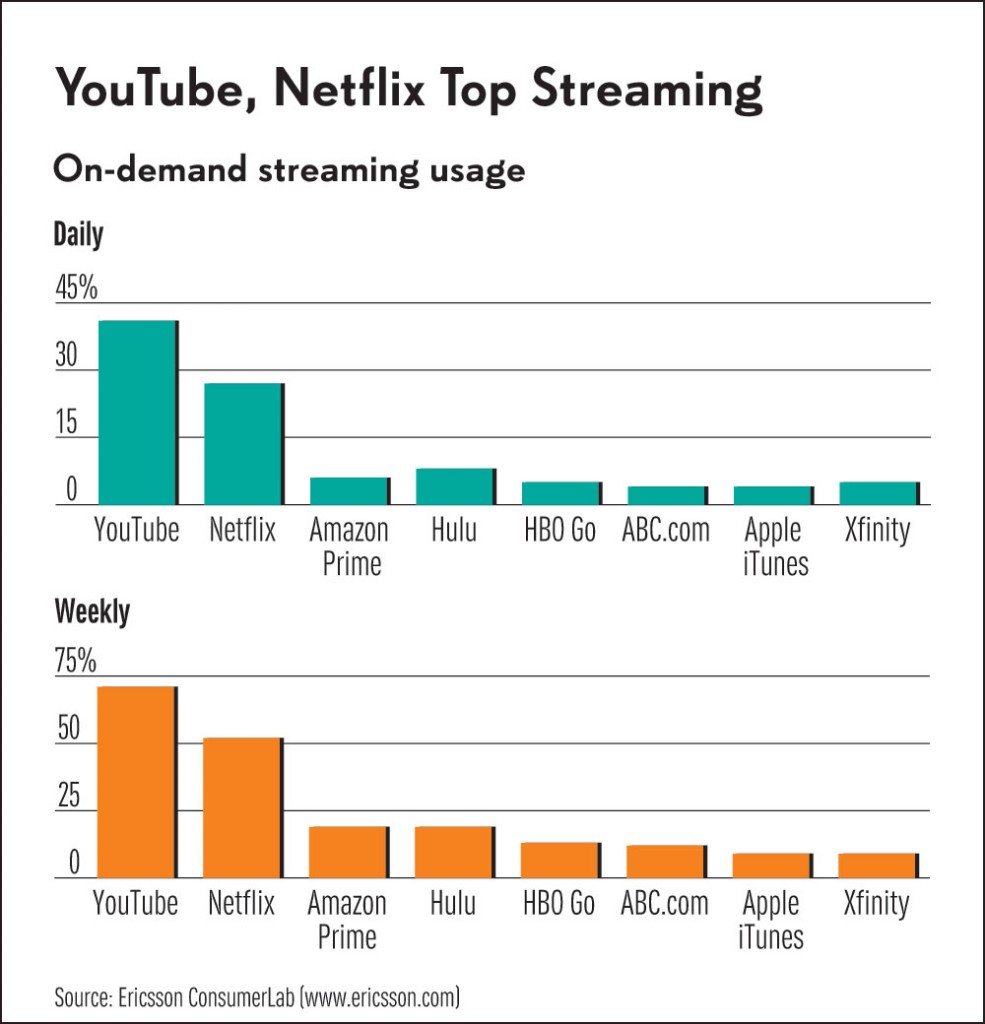

Ericsson says we spend about a third of our TV watching time with on-demand programming today, about twice as much as we did four years ago. Given that on-demand prevents commercial skipping, opens a market for targeted ads, provides consumers with greater choice, and doesn’t impose unacceptable costs on broadband providers, it’s reasonably clear that present trends will continue and within two to three years we will watch more on-demand than linear TV.

Along with this shift in the way we watch TV, we’re seeing additional options opening up for broadband. Google has discovered it can cherry pick markets with governments willing to reduce entry barriers to new broadband networks such as Kansas City and Austin. It has also discovered that it can target apartment buildings in other markets with services that don’t cover large geographic areas simply by leasing dark fiber. This is happening in San Francisco now, where Webpass and Sonic pursue a similar strategy.

The dark fiber that Google, Webpass, and Sonic lease will also be the backhaul for gigabit 5G wireless services within the next two to three years as well, as Dino Flore told us on a recent podcast. 5G will enable all the wireless carriers to provide greatly expanded versions of the cable-like service T-Mobile calls Binge-On. With Sling TV and the T-Mobile service, it’s easier than ever before to cut the cord.

Some critics maintain that cable is in denial about the willingness of consumers to cut the cord:

While cable operators continue to ‘laugh off’ slower and less reliable wireless broadband networks, BTIG analyst Walter Piecyk said they need to wake up and realize that the declining prices of wireless data is making it an increasingly compelling alternative…

Sandvine research noting that a typical household uses around 22 GB of broadband data a month, Piecyk said consumers could be enticed to ditch their wired broadband services by adding, say, 15 GB a month to their wireless data plan.

“The drop in price of larger data buckets to [incentivize] customers to migrate up to larger data buckets has been effective,” the analyst said. “More than half of AT&T data share customers are on 10 GB plans and more than one third are on 15 GB plans or higher. These larger buckets make wireless an increasingly compelling alternative to wired broadband.”

A great deal of the pressure to cut the cord comes from the increasing cost of cable bundles, imposed by programmers eager to cross-pollinate more popular and less popular programming for all the obvious reasons.

Given these trends, it’s not immediately obvious that the FCC should be trying to preserve devices like the set-top box whose sole purpose in life is to enable the viewing of linear TV. At best, the new STB plan the FCC has floated will not find traction with viewers for four to five years, at which time TV viewing will be at least 80 percent on-demand.

So the STB plan is a real head-scratcher.